If you’re the type who likes their coffee strong and their trades fast, you’ve landed in the right spot. Day trading isn’t just about making quick decisions; it’s about smart ones. It’s where the adrenaline of trading meets the strategy of chess, all before lunchtime.

In this article, we’ll walk you through the nuts and bolts of day trading in Forex. We’ll tackle the must-know strategies that keep top traders ahead, debunk a few myths that might be holding you back, and get into the nitty-gritty of what really makes the market tick. Whether you’re just starting out or looking to brush up on your skills, we’ve got something for you.

So grab your favorite beverage, settle in, and let’s break down the ins and outs of day trading. Ready to turn those quick wits into quick wins?

Understanding Different Types of Forex Traders

Alright, let’s kick things off by getting to know the neighborhood! The Forex market is like a bustling city, and each trader has their own way of navigating the hustle and bustle. Broadly speaking, traders fall into one of three camps: Day Traders, Swing Traders, and Position Traders. Let’s take a quick tour to see which style might suit you best.

Day Traders: The Sprinters

Day traders are the sprinters of the Forex world. They’re in and out before you can say “volatile market.” These traders thrive on the adrenaline rush of rapid trades, often holding positions for just minutes or hours. They utilize short-term charts like 1-minute or 5-minute intervals to make their moves. If you love a fast-paced environment and can make decisions on the fly, day trading might just be your game.

Swing Traders: The Middle-Distance Runners

Next up, we have the swing traders. These folks are the middle-distance runners of trading. They find the sweet spot between the sprint of day trading and the marathon of position trading. Swing traders typically hold positions for several days to a few weeks, using charts that range from 1-hour to daily. This style is great if you’re looking for gains that are a bit more substantial than a day trade, but without the long-term commitment of a position trade.

Position Traders: The Marathoners

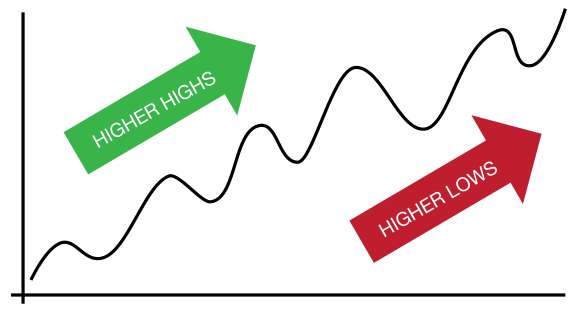

Lastly, meet the marathoners of the market—position traders. These traders are in it for the long haul, often holding positions for months to years. They rely on daily to monthly charts to guide their decisions and are less concerned with short-term fluctuations, focusing instead on the bigger, long-term trends. If you’ve got patience and a penchant for in-depth research, position trading could be your path to profits.

| Trading Style | Time Frame | Risk Level | Potential Gains |

|---|---|---|---|

| Day Traders | Minutes to hours | High | Low to moderate |

| Swing Traders | Days to weeks | Medium | Moderate |

| Position Traders | Months to years | Low | High |

Finding Your Fit

Each trading style has its rhythm and requires a different set of skills and temperament. The key to success in Forex trading is not just understanding the market, but also understanding yourself. What’s your risk tolerance? How much time can you dedicate to trading? Answering these questions will help you identify which trading style aligns best with your goals and lifestyle.

Day Trading Detailed

It’s fast, frenetic, and yes, it can be fantastically rewarding if you play your cards right. Let’s break down the strategies, tools, and psychological hacks you need to thrive in the high-speed arena of day trading.

Core Strategies for Success

Day trading isn’t just about rapid transactions; it’s about making smart, calculated moves based on solid strategies. Here are the essentials:

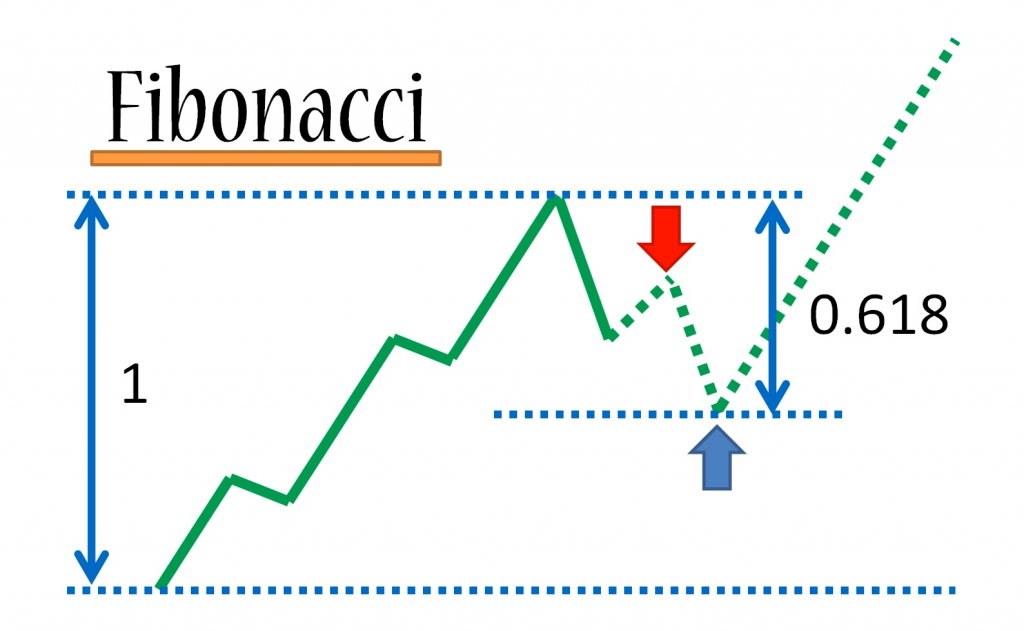

- Technical Analysis: This is your bread and butter. Learn to read and interpret charts quickly. Focus on patterns, trend lines, and volume indicators to make informed decisions swiftly.

- Scalping: This popular strategy involves making numerous trades to snatch small profits on minimal price changes throughout the day. It’s all about volume and speed.

- News-Based Trading: Economic announcements can cause quick price movements. If you’re keen and quick, you can leverage these moments by anticipating market reactions to news events.

- Risk Management: Set a strict stop-loss order for every trade. This limits potential losses and helps manage the overall risk of your trading activities.

Essential Tools for the Trade

To keep up with the fast pace of Forex day trading, you’ll need some robust tools under your belt:

- High-Speed Internet: Delays can be costly. Ensure your connection is lightning-fast.

- Reliable Trading Platform: Choose platforms known for speed and reliability. Features like automatic stop-loss settings and quick execution are must-haves.

- Real-Time Data: Access to immediate market data is crucial. Use platforms that offer real-time charts and updates without lag.

Psychological Tips to Keep You Sharp

The mental game of day trading is just as important as the technical side. Here’s how to stay sharp:

- Stay Disciplined: Stick to your trading plan and resist the urge to trade on impulse. Consistency is key.

- Emotional Detachment: Learn to detach from wins and losses. Treat trading like a business and avoid emotional trading.

- Continuous Learning: The market is always changing, and so should you. Keep learning and adapting your strategies.

Debunking Day Trading Myths

Day trading often comes wrapped in myths and misconceptions that can deter new traders or create unrealistic expectations. Let’s set the record straight on some of the most common myths, helping you approach day trading with a clearer, more accurate perspective.

Myth 1: “Day Trading is Excessively Risky”

Reality: While day trading involves significant risk due to its fast-paced nature, it doesn’t necessarily mean it’s riskier than other forms of trading. Effective risk management strategies, such as setting stop-loss orders and only risking a small percentage of your portfolio on any single trade, can help mitigate these risks. Plus, the absence of overnight risk (market moves while you sleep) can actually lower certain kinds of financial exposure.

Myth 2: “It’s Only Profitable for Brokers”

Reality: It’s true that brokers benefit from the increased transaction volume generated by day traders, but this doesn’t mean traders can’t also be profitable. With the right skills, tools, and discipline, day traders can capture profits from short-term market fluctuations. Success in day trading comes from consistent performance and strategic planning, not mere luck or broker favoritism.

Myth 3: “You Need to Watch the Markets All Day”

Reality: While staying informed is crucial, you don’t need to glue yourself to your computer screen all day to succeed in day trading. Many successful traders spend only a few hours trading during the most volatile market periods, such as the market opening or closing. You can efficiently manage your time and attention by using automated trading systems or setting up trade alerts.

Myth 4: “Day Trading is Like Gambling”

Reality: Day trading, when done correctly, is nothing like gambling. Unlike random bets, day trading involves systematic analysis, informed decision-making, and careful risk management. Traders who treat day trading seriously use statistical and analytical methods to find and execute their trades, which is far from making random guesses.

Myth 5: “You Have to Know Everything Happening in the Market”

Reality: Successful day trading doesn’t require omniscience about every market move or news event. Instead, focusing on a specific niche or a set of currency pairs can be more effective. Traders can use specialized knowledge to gain an edge in their chosen areas, rather than diluting their efforts across too much information.

Can You Live Off Day Trading?

One of the most compelling questions about day trading is whether it’s possible to make a living off it. The answer is yes, but it comes with several caveats and requires a combination of skill, discipline, and the right market conditions. Let’s show you what it takes to turn day trading into a full-time career potentially.

Financial and Psychological Preparedness

Capital Requirements: To sustain a living through day trading, you must have enough capital to generate reasonable returns while managing risk. Day trading often involves leveraging large amounts of capital to take advantage of small price movements. If your capital base is too small, the returns might not be sufficient to cover living expenses, especially after accounting for taxes and trading costs.

Emotional Resilience: Day trading can be a psychological rollercoaster. The stress of potentially losing money daily requires a robust emotional temperament. Traders must be able to handle intense periods of stress and recover from losses without emotional fallout, which can affect their decision-making and overall mental health.

Strategy and Skill Development

Effective Trading Strategy: Successful day traders rely on well-tested strategies that offer a statistical edge in the market. These strategies are developed through extensive research, back-testing, and continuous refinement.

Skill Improvement: Day trading skills are honed over time with experience and constant learning. The market evolves, and so should a trader’s tactics and strategies. Professional development through courses, mentorship, and staying updated with financial news is critical.

Realistic Expectations and Lifestyle Considerations

Income Variability: Unlike a regular salary, income from day trading can be highly unpredictable. This variability can make budgeting and financial planning challenging. Potential traders need to have a financial buffer to handle periods when profits are lean.

Lifestyle Impact: Day trading as a full-time job requires a commitment that extends beyond traditional working hours. Market preparation, strategy development, and review sessions take considerable time and can encroach on personal life.

Legal and Regulatory Requirements

Regulatory Knowledge: Traders must understand and comply with the legal and regulatory requirements in their jurisdictions. This includes maintaining proper records, reporting income, and understanding the tax implications of trading activities.

Conclusion

This fast-paced arena offers unique opportunities for those prepared to tackle its challenges. From understanding the different types of traders to debunking common myths and learning from successful case studies, we’ve covered a wide array of essential topics that arm you with the knowledge needed to navigate day trading effectively.

If you’re feeling inspired and ready to take your trading to the next level, here are some actionable steps to get you started:

- Educate Yourself: Continue to learn and refine your trading skills. Consider enrolling in specialized courses or workshops that focus on technical analysis, risk management, and trading psychology.

- Start Small: If you’re new to day trading, begin with a demo account to practice your strategies without financial risk. Once you’re comfortable, you can start trading with small amounts to gain real-world experience.

- Develop a Trading Plan: Based on the insights gained from this article, craft a trading plan that suits your risk tolerance, investment goals, and schedule. A well-thought-out plan is your roadmap to success in day trading.

- Join a Community: Connect with other traders by joining trading forums, groups, or online communities. Sharing experiences and strategies with peers can provide support and deepen your understanding of the market dynamics.

- Stay Updated: The Forex market is continuously evolving. Keep yourself updated with the latest news, trends, and economic events that can impact currency movements.

- Stay Disciplined: Always stick to your trading plan and maintain discipline, especially when faced with the inevitable ups and downs of the market.

Remember, successful day trading doesn’t happen overnight. It requires patience, dedication, and a continual commitment to learning and adaptation. By taking proactive steps and consistently applying the strategies and tips outlined in this guide, you’re well on your way to becoming a proficient day trader. Here’s to making informed and strategic trades—may your trading journey be as rewarding as it is exhilarating! Happy trading!