Every forex trader needs to have a trading edge – defined as having a statistical advantage over other traders or market participants. Our edge (trading strategy) is in being able to decipher what is happening in the Forex market on a daily basis. In order to do this, we use a variety of tools and follow a step by step approach dictated by our carefully crafted trading plan.

Irrespective of whatever forex trading strategy you use, it is imperative that you have a specific plan ranging from how to identify a setup to how to execute your forex strategy and manage trade risk. Our approach is as follows:

Our Forex Trading Strategy

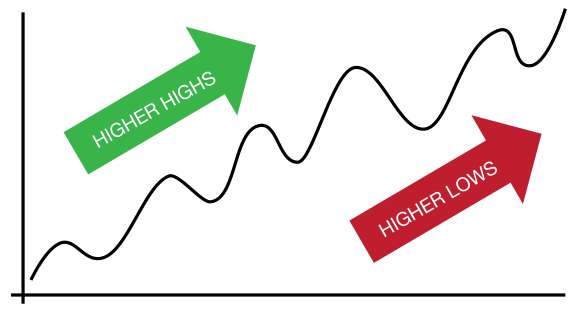

Step 1: Trend identification and smart money cycle

The first thing we do each day is to understand what the overall sentiment is, whether there is a dominant bullish or bearish bias. We then look at where we are in the smart money cycle – whether we are looking for smart money buying pressure or selling pressure to drive the market. Understanding the smart money cycles is crucial as it protects us from being on the wrong side of the forex market and ensuring we are in line with how the large institutions are thinking.

It is imperative to begin each day with a dominant bias based on assessing market sentiment. That market sentiment is driven by smart money (market makers and trading institutions) and so trading successfully depends on being able to track these players successfully. Too many forex traders dive straight into a trade without doing this part properly. Have a plan for your trading strategy.

Step 2: Locating Deep Liquidity Pools

The next step in our approach is to locate where smart money is likely to buy or sell in line with their cycle. These areas tend to be in large pools of liquidity due to the fact that large institutions and market makers are looking to transact big volumes and therefore need places where they are likely to get the quantity of orders they need for their forex trades. We work with the assumption that the areas with the deepest liquidity are more likely to attract the greatest market participation and we focus on these as our potential forex trading zones. There are various ways of locating such liquidity pools but one of the main ones we use is confluence.

Step 3: Identify Areas of Confluence

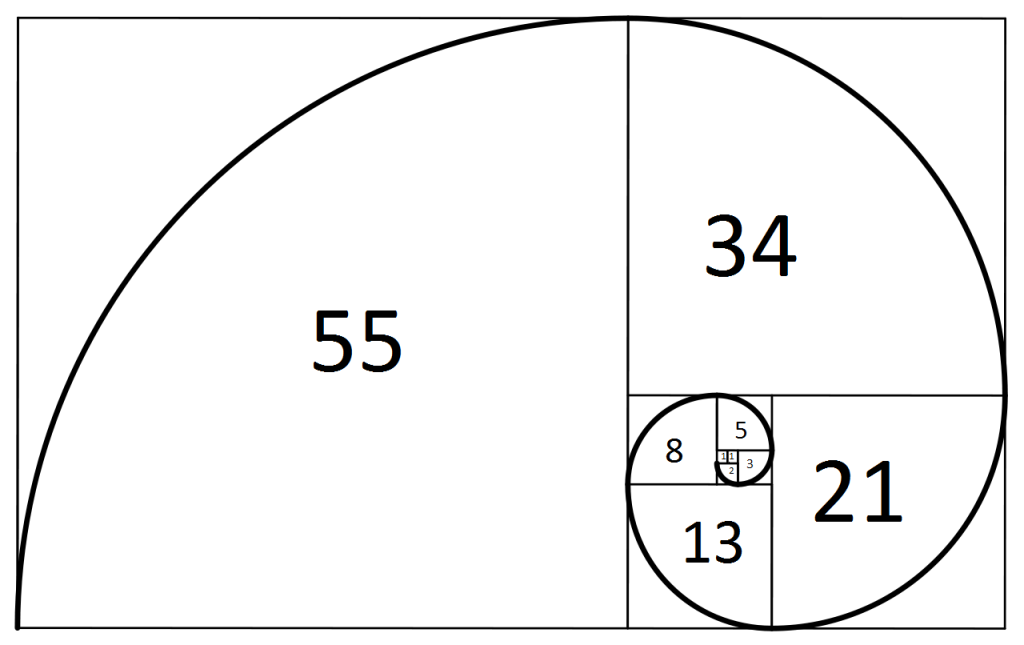

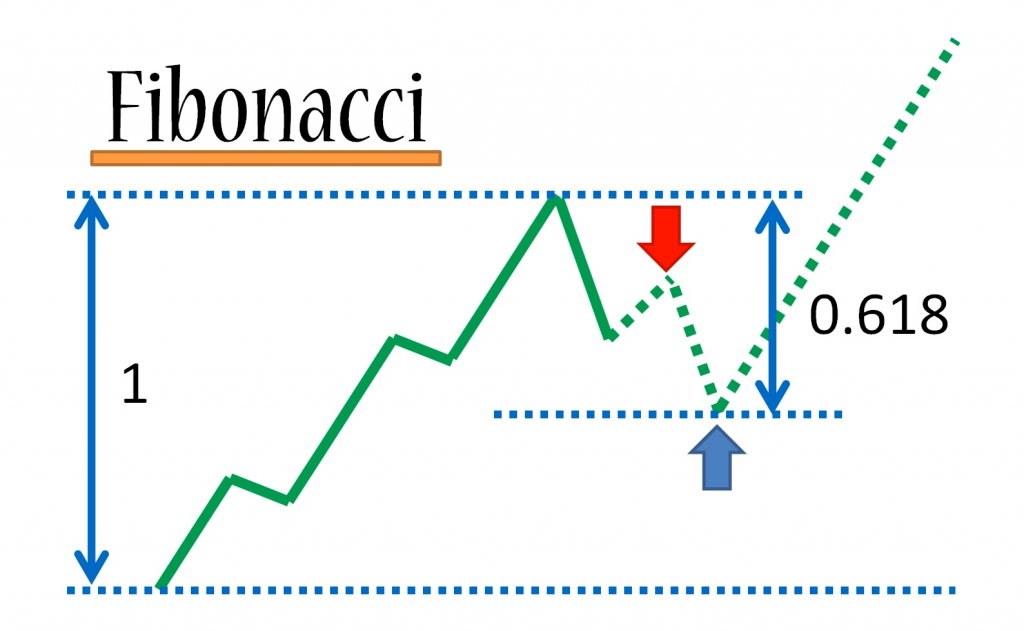

Since we are looking for the areas with the deepest liquidity, we use a combination of support and resistance, Elliot wave counts, ABCD patterns, moving averages, ADR, round numbers and supply and demand in order to arrive at the point with the highest combination of factors. This becomes our high probability trading zone where we expect smart money to execute their trades. This approach also filters for weak versus strong liquidity pools.

In a $5 Trillion a day market such as Forex, there will be hundreds of places where liquidity can be located but distinguishing between which ones to focus on and which ones to avoid takes skill and practice. For a start as retail traders, you do not have access to order flow to determine where the litters of orders are in the market. This means we have to rely on alternative techniques to identify order flow in order to determine which price or level has the largest build up of orders for smart money to manipulate.

Step 4: Identification of Market Manipulation

Once price moves into our anticipated level of high liquidity, we expect smart money to manipulate price at that level to entice retail traders into a position before reversing it. Since smart money ultimately is responsible for pushing the price into the identified area, we expect them to fulfill the second part of their plan which is to absorb orders waiting at those levels.

We use price action and volume analysis to determine whether smart money has manipulated price or not. Once we see evidence of manipulation then we enter a forex trade in line with smart money’s movement. This manipulation normally is accompanied by a stop run and an aggressive move off the level. We look for a specific price action pattern to occur at these zones and once it does, it signals that smart money has indeed turned up to push price in their chosen direction.

Step 5: Trade Management

No strategy is foolproof hence why using a stop loss and effective trade management is very important in a trading approach. We use strong money management principles. This ranges from having a predefined stop loss to knowing where to exit once the trade has moved in our favor. We risk a conservative amount of our capital per trade and look for a high reward to risk opportunities. Every trade we enter must have the potential to give at least a 2:1 outcome. If this rule is met then we take the trade, if it isn’t then we avoid it.

Our stop loss placement is very important – we place our stop loss at a safe distance from our entry and have a maximum amount which we never exceed. Once the trade moves in our favor, we look for an exit at predefined levels using a combination of targeting techniques which include support & resistance, demand & supply zones, potential manipulation areas, Fibonacci projection levels, ADR.

So the above 5 step process is how we trade and the thought process that we go through in identifying potential trades. It gives us an edge in the market and clarity when making a decision.

For more great content check out these articles

Stop Hunts & Market Manipulation

How To Create A Trading Master Plan

Day Trading Vs Swing Trading Vs Position Trading – Which One is Best?

Trading with Fibonacci Part 1: Who And What Is Fibonacci?