Forex trading rooms, often shrouded in the mystique of the financial world, play a crucial role in the foreign exchange market. These dynamic spaces allow traders to collaborate, share insights, and enhance their trading skills. This comprehensive guide will unravel the intricacies of forex trading rooms, exploring how they work, the benefits they offer, and the considerations when choosing one. Whether you’re a novice trader or an experienced handler, this article will equip you with the knowledge to navigate the world of forex trading rooms confidently.

Quick Tips for Exploring Forex Trading Rooms

Before we dive into the depths of forex trading rooms, here are some quick tips to get you started on your journey:

1. Understand Your Goals: Clearly define your objectives. Are you looking to learn, receive trading signals, or network with other traders?

2. Research Thoroughly: Investigate various forex trading rooms to determine their reputation, credibility, and track record.

3. Trial Period: Most trading rooms offer trial periods or free access. Take advantage of these to evaluate if they align with your trading style.

4. Compatibility Matters: Ensure the trading room’s strategies and style are compatible with your trading preferences and risk tolerance.

5. Seek Community and Support: Choose a trading room that fosters a supportive community. The ability to connect with fellow traders can be invaluable.

Now, let’s delve into the article’s core to gain a deep understanding of forex trading rooms and how they operate.

The Basics of Forex Trading

Before we explore the intricacies of forex trading rooms, it’s essential to establish a solid foundation in the basics of forex trading.

A. Brief Overview of the Forex Market

The foreign exchange market, often referred to as forex or FX, is the world’s largest financial market. It involves the exchange of currencies, where participants buy one currency and sell another simultaneously. This global market operates 24 hours a day, five days a week, and is decentralized, meaning there is no central exchange.

B. The Role of Forex Traders

Forex traders play a pivotal role in the market. They speculate on the price movements of various currency pairs, aiming to profit from fluctuations. Successful trading in the forex market requires a blend of technical and fundamental analysis, risk management, and strategy development.

C. The Need for Real-time Information and Analysis

Given the forex market’s fast-paced and highly volatile nature, traders require real-time information and analysis to make informed decisions. This is where forex trading rooms come into play.

What Are Forex Trading Rooms?

A. Definition and Purpose

Forex trading rooms are dedicated physical or virtual spaces where traders come together to share insights, exchange ideas, and collaborate on trading strategies. The primary purpose is to facilitate the decision-making process and enhance the trading skills of participants.

B. Types of Forex Trading Rooms

1. Physical Trading Rooms

Physical trading rooms are where traders gather to discuss and execute trades. While these were more common in the past, technological advancements have led to a shift towards virtual trading rooms.

2. Virtual Trading Rooms

Virtual trading rooms are online platforms or communities where traders communicate, collaborate, and execute trades. These are more accessible and widely used in today’s digital age.

C. Key Participants

In a forex trading room, you’ll encounter various vital participants:

1. Traders

These are individuals actively participating in the forex market. They utilize trading rooms to share their strategies, get feedback, and access real-time market data.

2. Analysts

Analysts in trading rooms provide market analysis, technical and fundamental insights, and trade setups to assist traders in making informed decisions.

3. Moderators or Mentors

Moderators or mentors are experienced traders who guide and mentor other members, offering valuable advice and support.

4. Technology and Tools

Trading rooms often feature advanced technology and tools, such as charting software, real-time data feeds, and trading platforms, to aid traders in their activities.

D. Access and Membership

To participate in a forex trading room, you typically need to become a member, which may involve subscription fees or a one-time payment. Different trading rooms have various membership models, so it’s essential to understand the terms before joining.

How Forex Trading Rooms Operate

Now that we’ve established the fundamentals, let’s explore how forex trading rooms operate in more detail.

A. Real-time Information Feeds

Forex trading rooms are a treasure trove of real-time information, including:

1. Currency Pairs and Quotes

Members receive up-to-the-second data on currency pairs, along with their respective quotes. This information is essential for traders to make timely decisions.

2. News and Economic Events

Trading rooms often provide access to news feeds and economic calendars. This allows traders to stay informed about global events and financial data releases that can impact currency prices.

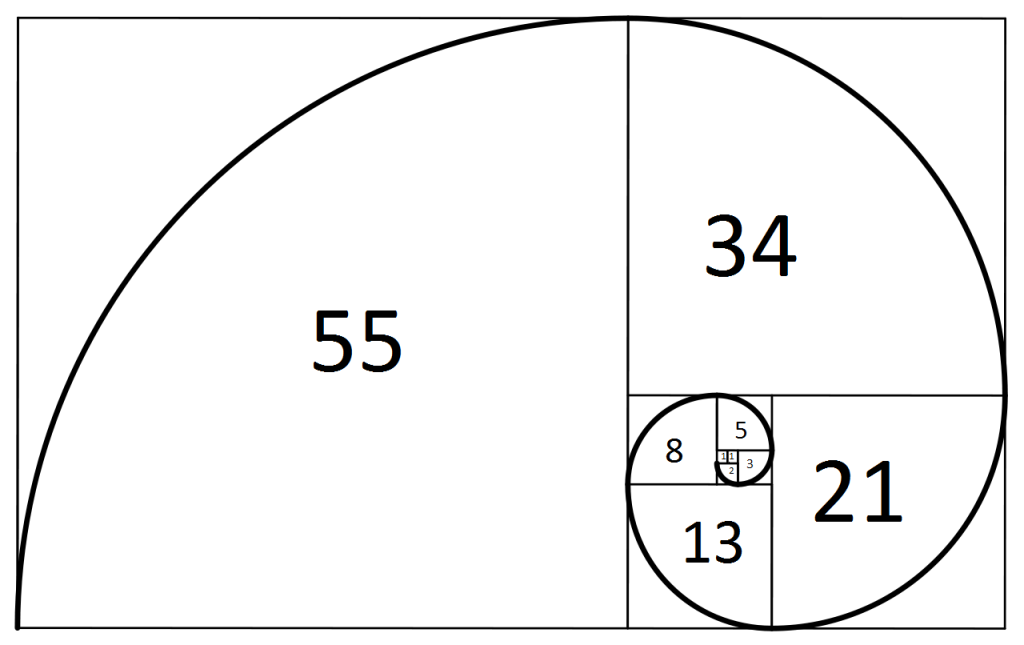

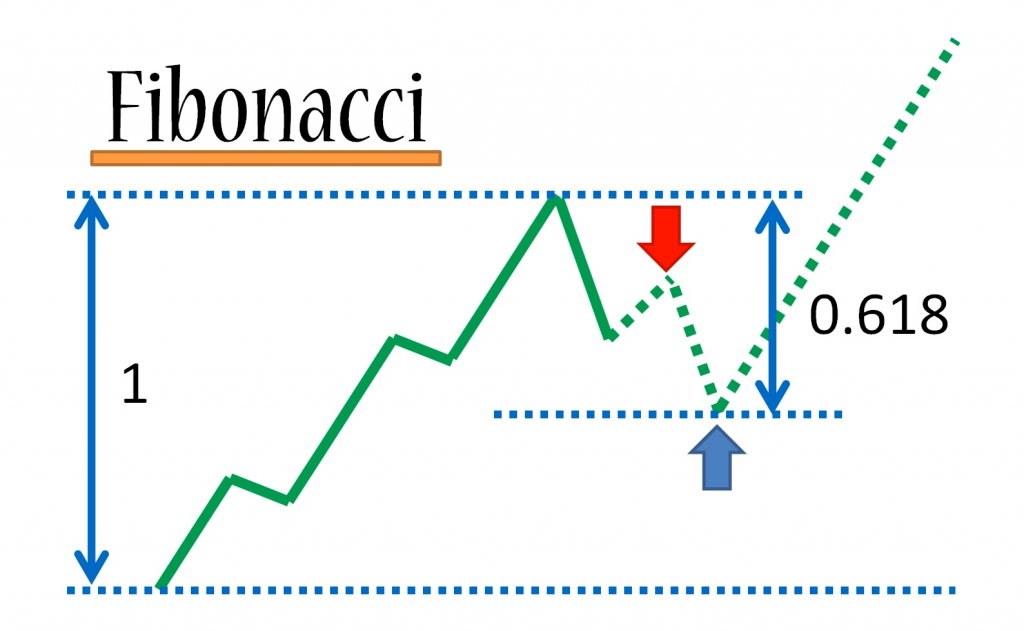

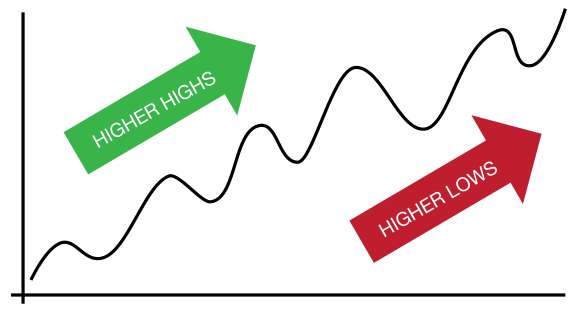

B. Technical and Fundamental Analysis

In a trading room, traders and analysts share technical and fundamental analysis. Technical analysis involves studying price charts, indicators, and patterns, while fundamental analysis assesses economic factors affecting currency values.

C. Trading Strategies

Trading rooms are a hub for trading strategies. Members discuss and share their strategies, from day trading and scalping to swing trading and long-term investing. This collective sharing of strategies can be highly educational.

D. Trade Setups and Signals

Many trading rooms provide trade setups and signals, allowing members to follow expert recommendations or algorithmic trading systems. These signals can be valuable for traders seeking assistance in executing profitable trades.

E. Risk Management and Trade Execution

Risk management is a crucial aspect of forex trading. You’ll often find discussions on risk management techniques and tips for executing trades effectively in trading rooms.

F. Interaction and Communication

Effective communication is the backbone of trading rooms. Members engage in live chats, discussion forums, webinars, and video conferences to exchange ideas, ask questions, and learn from one another.

Advantages of Using Forex Trading Rooms

Forex trading rooms offer many advantages that can significantly benefit traders at all levels of expertise. Here are some key advantages:

A. Learning and Education

Trading rooms are educational hubs where novice traders can learn from experienced professionals. They provide access to a wealth of knowledge, helping individuals develop trading skills and strategies.

B. Trading Ideas and Insights

Members gain access to a diverse range of trading ideas and insights from analysts and fellow traders. This exposure can inspire creativity and innovation in your trading approach.

C. Emotional Support and Discipline

Trading can be emotionally taxing. Trading rooms provide emotional support and discipline, with mentors and peers offering guidance during challenging times.

D. Networking and Community

Participating in a trading room connects you with a community of like-minded individuals. Networking with others who share your passion for forex can motivate and foster collaborative opportunities.

E. Enhancing Decision-Making

With real-time information, expert analysis, and peer discussions, trading rooms empower traders to make more informed and confident decisions, potentially leading to better trading outcomes.

Challenges and Considerations

While forex trading rooms offer numerous benefits, there are challenges and considerations to consider.

A. Costs and Fees

Membership in trading rooms often comes with costs, such as subscription fees. It’s essential to assess whether the fees align with your budget and potential returns.

B. Quality and Credibility

Not all trading rooms are created equal. Some may need more credibility or provide low-quality information. Research and due diligence are essential to choosing a reputable room.

C. Overreliance and Lack of Independence

Relying entirely on a trading room’s signals and advice can hinder your ability to develop independent trading skills. It’s essential to strike a balance between learning and applying your judgment.

D. Time Commitment

Active participation in a trading room requires a significant time commitment. Ensure you can allocate enough time to make the experience worthwhile.

E. Security and Privacy

When participating in virtual trading rooms, safeguard your personal and financial information. Use secure and reputable platforms to protect your data.

Tips for Choosing the Right Forex Trading Room

Selecting the fitting trading room is a critical decision that can significantly impact your trading journey. Here are some tips to help you make an informed choice:

A. Research and Due Diligence

Conduct extensive research on various trading rooms. Look for online reviews, testimonials, and independent assessments to gauge the room’s reputation.

B. Trial Period and Evaluations

Take advantage of any trial or free periods offered by trading rooms. This lets you assess whether the room aligns with your trading style and goals.

C. Compatibility with Your Trading Style

Ensure that the strategies and trading styles promoted in the room match your preferences. A mismatch can lead to frustration and poor results.

D. Community and User Reviews

Seek feedback from other members of the trading room. User reviews can provide valuable insights into the room’s strengths and weaknesses.

Success Stories and Case Studies

To illustrate the potential benefits of forex trading rooms, let’s take a look at a few success stories:

1. Examples of Traders Benefitting from Forex Trading Rooms

- Sarah: a novice trader, Sarah joined a reputable trading room to learn from experienced mentors. With their guidance, she developed effective trading strategies and achieved consistent profits.

- David: a professional trader, David sought a trading room for signals and analysis to complement his strategy. By following the room’s recommendations, he improved his trading performance.

2. Notable Trading Room Success Stories

- ForexSignals.com: This trading room has gained recognition for its educational content, live trading sessions, and trade setups. Many members have reported substantial improvements in their trading skills and results.

The Future of Forex Trading Rooms

As technology evolves, forex trading rooms are expected to follow suit. Here’s a glimpse into the potential future of these spaces:

A. Technological Advancements

Advancements in trading technology will likely lead to more sophisticated and user-friendly trading rooms with enhanced tools and features.

B. Trends and Innovations

Expect to see trends like algorithmic trading, artificial intelligence, and social trading integrated into trading rooms, providing traders with new opportunities.

C. Potential Challenges and Evolution

Forex trading rooms will need to adapt to regulatory changes and increased scrutiny. Ensuring transparency and adhering to industry standards will be critical for their survival and success.

Things You Can Purchase in Forex Trading Rooms

| Item | Description | Price Range |

| Monthly Membership | Access to a trading room for a month | $50 – $300 |

| Annual Membership | Annual subscription for continuous access | $400 – $2,000 |

| Trading Signals | Real-time trade recommendations | $50 – $500 per month |

| Educational Webinars | Online courses and webinars on forex trading | $100 – $500 |

| Expert Analysis Reports | In-depth market analysis reports | $20 – $100 |

| Algorithmic Trading Systems | Automated trading systems for hands-free trading | Varies widely |

| Exclusive Community Access | Premium community forums and support | $30 – $200 per month |

| Private Mentoring | One-on-one mentoring by experienced traders | $100 – $500 per hour |

| Trading Software and Tools | Specialized trading software and analytical tools | Varies widely |

Please note that the prices listed above are approximate and may vary depending on the specific trading room and its offerings. It’s essential to carefully evaluate the value provided by each item before making a purchase decision.

Forex trading rooms offer a valuable resource for traders, from education and networking to real-time information and expert insights. However, selecting the fitting trading room and managing costs are essential considerations. With the knowledge gained from this guide, you are better equipped to explore forex trading rooms and harness their potential to improve your trading endeavors.