The world of foreign exchange trading, commonly known as Forex, is a dynamic and potentially rewarding marketplace. But, like any other field, understanding the terminology and jargon used in Forex is a crucial first step to success. This article will delve into the essential Forex glossary terms you need to know to navigate this complex financial landscape effectively.

Whether you are new to Forex trading or have some experience, mastering these key terms will empower you to make informed decisions and mitigate risks. To kick things off, let’s begin with some quick tips to remember as you embark on your Forex journey.

Quick Tips for Forex Success

1. Start with a Solid Educational Foundation: Learn the basics before diving into live trading. Understand the key terms, market dynamics, and various trading strategies.

2. Practice with a Demo Account: Most brokers offer demo accounts that allow you to trade with virtual money. It’s an excellent way to gain practical experience without risking your capital.

3. Stay Informed: Keep a close eye on economic news and events that can impact currency values. Economic calendars are valuable tools for this purpose.

4. Use Risk Management Tools: Familiarize yourself with risk management terms like stop-loss, leverage, and Margin. These are critical for protecting your investment.

5. Emotional Discipline is Key: Trading can be emotionally taxing. Develop the mental fortitude to stick to your strategy and not make impulsive decisions.

Now, let’s explore the Forex glossary terms in detail, providing you with a comprehensive understanding of this exciting market.

Essential Forex Terminology

1. Currency Pairs

- Definition and Examples: In Forex, you trade one currency for another, making pairs essential. For example, EUR/USD represents the Euro to US Dollar exchange rate.

- Major, Minor, and Exotic Pairs: Major pairs involve strong economies like EUR/USD and USD/JPY. Minor pairs don’t include the US Dollar, while exotic pairs involve one firm and a weaker currency.

2. Exchange Rate

- Definition and Calculation: An exchange rate is the value of one currency concerning another. It’s calculated as the ratio of one currency’s value to another. The bid price is what buyers pay, while the ask price is what sellers receive.

3. Pip

- Definition and Significance: A pip is the slightest price movement in the exchange rate of a currency pair. It’s essential for measuring price changes. In most currency pairs, a pip is 0.0001.

- Pipettes: Sometimes, a pipette denotes the fifth decimal place, 0.00001. Pipettes are especially relevant in some minor and exotic pairs.

4. Leverage

- Explanation of Leverage in Forex Trading: Leverage allows you to control a prominent position with a relatively small capital. For instance, a 50:1 leverage means you can hold $50,000 with only $1,000 in your account.

- Risks and Benefits: While leverage can magnify profits, it also increases potential losses. Understanding leverage is crucial for responsible trading.

5. Margin

- What is Margin? Margin is the money you need to open and maintain a position in your trading account. It’s often expressed as a percentage of the trade size.

- Margin Call and Stop-Out Level: A margin call occurs when your account balance falls below the required Margin. The stop-out level is when your broker closes your positions to prevent further losses.

Order Types

1. Market Orders

- Definition and Execution: A market order is to buy or sell a currency pair at the current market price. It’s executed immediately.

- Pros and Cons: Market orders offer speed and certainty of execution but may not guarantee a specific price.

2. Limit Orders

- Definition and Purpose: A limit order is buying or selling at a specific price or better. It’s used to enter or exit the market at a predefined level.

- How to Use Limit Orders Effectively: Limit orders can help you achieve a desired entry or exit price without constantly monitoring the market.

3. Stop Orders

- Definition and Types (Stop-Loss and Take-Profit): Stop orders are used to limit losses (stop-loss) or secure profits (take-profit) at specific price levels.

- Risk Management with Stop Orders: Setting stop-loss orders is vital to risk management, helping you protect your trading capital.

Technical Analysis Terms

1. Candlestick Patterns

- Explanation and Examples: Candlestick patterns are visual representations of price movements. Examples include doji, engulfing patterns, and hammers.

- How to Interpret Candlestick Patterns: These patterns help traders identify potential market reversals or continuations.

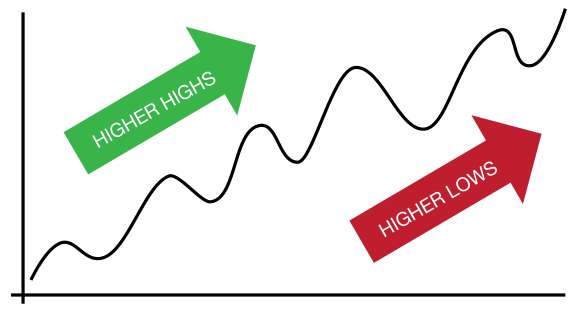

2. Moving Averages

- Simple and Exponential Moving Averages: Moving averages smooth out price data, making trends more apparent. The simple moving average (SMA) and exponential moving average (EMA) are typical.

- Their Role in Trend Analysis: Moving averages are essential tools for determining the direction of a trend.

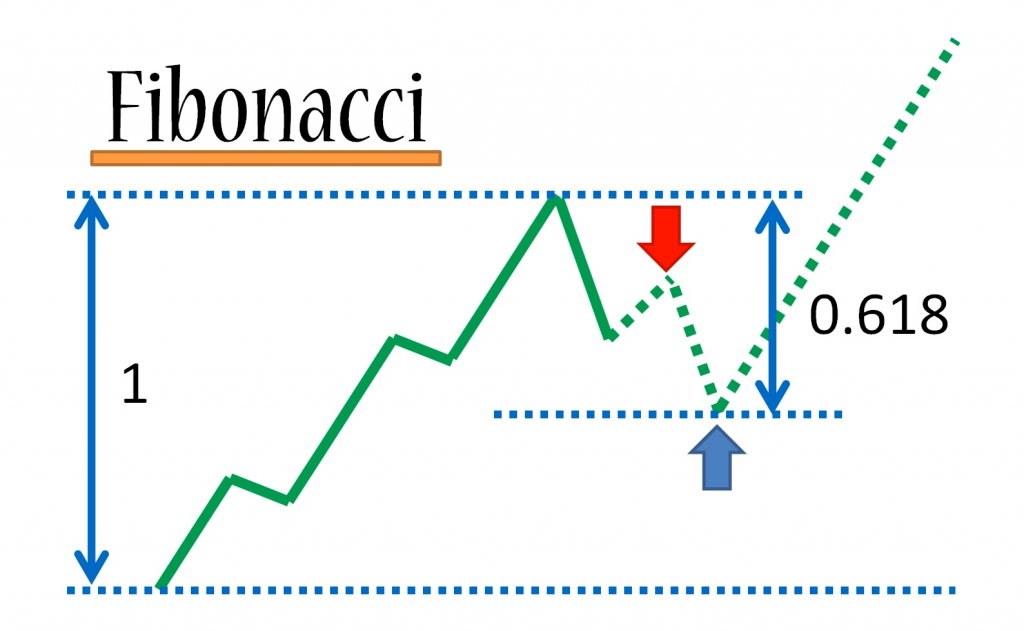

3. Support and Resistance

- Definition and Significance: Support is a price level where a currency pair tends to stop falling, while resistance is where it tends to stop rising.

- Identifying Key Levels: Recognizing support and resistance levels can help traders make informed decisions about entry and exit points.

Fundamental Analysis Terms

1. Economic Indicators

- Examples (e.g., GDP, CPI): Economic indicators like Gross Domestic Product (GDP) and Consumer Price Index (CPI) provide insights into a country’s economic health.

- How Economic Indicators Impact Currency Values: Positive economic indicators often lead to a stronger currency, while negative indicators can weaken it.

2. Interest Rates

- Central Bank Policies and Interest Rates: Central banks’ decisions on interest rates can significantly impact currency values.

- Carry Trade Strategy: Traders often use the carry trade strategy, borrowing funds in a currency with low interest rates and investing in one with higher rates.

3. Risk Sentiment

- Risk-On and Risk-Off Market Environments: Risk sentiment refers to the market’s willingness to take risks. During a risk-off period, investors seek safer assets, impacting currency values.

- Relationship to Currency Market Trends: Understanding risk sentiment can help you anticipate market movements in uncertain times.

Forex Broker Terminology

1. Spread

- Definition and Significance: The spread is the difference between the bid and ask prices in a currency pair. It represents the cost of trading.

- Fixed vs. Variable Spreads: Some brokers offer fixed spreads, while others have variable spreads that can widen during volatile market conditions.

2. Slippage

- Explanation and Causes: Slippage occurs when your order is executed at a different price than expected, often due to market volatility.

- How to Minimize Slippage: Limiting orders and trading during less volatile hours can reduce the likelihood of slippage.

3. Swap Rates (Roll-Over Rates)

- Definition and Calculation: Swap rates are the interest rate differentials between two currencies. They are applied to positions held overnight.

- Implications for Overnight Positions: Understanding swap rates is crucial for traders who hold positions overnight, as they can result in additional costs or income.

Risk Management and Trading Psychology

1. Volatility

- Understanding Market Volatility: Volatility measures the extent of price fluctuations in the market. It can present both opportunities and risks.

- Strategies for Trading in Volatile Markets: Consider using smaller position sizes and broader stop-loss orders to manage risk in volatile markets.

2. Emotional Discipline

- Common Psychological Challenges in Forex Trading: Greed, fear, and impatience can lead to emotional decision-making and impulsive trading.

- Tips for Maintaining Discipline: Develop a trading plan, use risk management tools, and focus on long-term goals to maintain emotional discipline.