Plume The Institutional-Grade RWA Chain

Bridging Traditional Finance with Blockchain Technology

Status: Mainnet (Live since January 2025)

Website: plumenetwork.xyz | Twitter: @PlumeDotXYZ

Plume runs a blockchain built specifically for bringing real-world assets into crypto. Beyond simple tokenization, the platform enables institutional and retail users alike to unlock new financial opportunities by bridging traditional assets like bonds and real estate with the programmable efficiency of blockchain technology.

Token at a Glance

| Token Symbol | PLUME |

|---|---|

| Total Supply | 10 billion (fixed cap) |

| Circulating Supply | 2 billion |

| Network | EVM-compatible Layer-1 |

| Main Utility | Staking, governance, transaction fees |

| Launch Date | January 21, 2025 |

| Current Price | $0.163 (April 2025) |

- Transaction Speed: 3-second block times with 5,000+ TPS

- Key Exchanges: Gate.io, KuCoin, Bybit, MEXC, UniSwap, PancakeSwap

- Total Value Locked: $40M+ (as of March 2025)

Project Background & Founding Story

The vision for Plume emerged from CEO Chris Yin’s experience at Goldman Sachs, where he witnessed firsthand the inefficiencies plaguing traditional finance. Throughout his 12-year career in TradFi, Yin recognized that while blockchain technology promised revolutionary change, existing platforms lacked the necessary infrastructure to properly tokenize and manage real-world assets.

Working with CTO Teddy Pornprinya, who had built sophisticated trading systems for major hedge funds, they developed the concept for a blockchain specifically designed around RWA tokenization. Their goal wasn’t merely to create another layer-1 chain, but to build a bridge connecting the vast pool of traditional assets to the programmable and efficient world of decentralized finance.

The team identified that the RWA sector wasn’t just another blockchain niche, but potentially the most significant growth area for crypto adoption. With experts projecting the tokenized bond market alone to reach $300 billion by 2030, they built Plume as the specialized infrastructure to capture this massive opportunity.

Key Facts & Milestones

Launch Timeline:

- January 15, 2025: Testnet launch with 100+ validator nodes

- January 21, 2025: Mainnet goes live

- February 2025: Integration with RWA.xyz analytics platform

- March 2025: SkyLink cross-chain system activated

Major Achievements:

| Date | Achievement | Impact |

|---|---|---|

| Jan 2025 | Listed on 5 major exchanges | Increased liquidity and accessibility |

| Feb 2025 | Partnership with Cobo | Institutional-grade custody solutions |

| Feb 2025 | CertiK security audit (95/100) | Enhanced platform security credibility |

| Mar 2025 | $25M RWAfi Ecosystem Fund | Supporting developers building on Plume |

| Mar 2025 | 16 blockchain integrations | Cross-chain interoperability via SkyLink |

For detailed partnership announcements, visit plumenetwork.xyz/news

Adoption Metrics:

- 180+ projects actively building on the Plume network

- $40M+ total value locked (TVL) within three months of launch

- 75,000+ unique wallet addresses created since mainnet

- Average 50,000 daily transactions

- $5B in institutional assets coming through Whinfell partnership

Roadmap & Future Plans

Upcoming Upgrades:

- Q2 2025: Mayet investment platform launch for simplified asset management

- Q3 2025: Enhanced cross-chain bridges for improved interoperability

- Q4 2025: Institutional-grade trading infrastructure to attract major players

- Q1 2026: Layer-2 scaling solution to handle increased transaction volume

Long-Term Goals:

- Build the largest specialized RWA tokenization platform in crypto

- Expand institutional partnerships across global financial centers

- Reach $50B in tokenized assets by 2027

- Launch dedicated RWA derivatives market

- Achieve carbon neutrality across operations by 2026

The team has prioritized both technical scalability and institutional adoption, recognizing that building the infrastructure is only half the journey. By targeting traditional finance partners, Plume aims to facilitate the migration of trillions in assets to blockchain rails.

Team & Leadership

Core Team:

- Chris Yin (CEO): Former Goldman Sachs VP with 12 years in traditional finance, specializing in asset structuring and institutional markets

- Teddy Pornprinya (CTO): Built sophisticated trading systems for multiple hedge funds, expert in high-throughput financial systems

- Jason Meng (Head of BD): Previously led partnerships at Aave and Compound, bringing deep DeFi ecosystem connections

- Shukyee Ma (CSO): Ex-BlackRock director with specialized expertise in RWA onboarding and compliance

Advisors & Partners:

- Strategic investment and advisory from YZI Labs (formerly Binance Labs)

- Technical guidance from Galaxy’s engineering team for institutional integration

- Regulatory compliance support from several top crypto law firms

What sets Plume apart is how the team bridges two worlds that rarely overlap effectively. While many crypto projects lack traditional finance expertise, and most TradFi veterans struggle with crypto innovation, Plume’s leadership combines both perspectives, creating a rare advantage in navigating the complex RWA landscape.

Investors

Plume has attracted significant capital from leading crypto funds, signaling strong institutional confidence in both the team and the RWA sector’s potential:

Major Backers:

- YZI Labs (formerly Binance Labs)

- Brevan Howard Digital

- Haun Ventures

- Galaxy Digital

- Jump Trading

Funding History:

| Round | Amount | Date | Lead Investors |

|---|---|---|---|

| Seed | $30M | Q3 2024 | YZI Labs, Jump Trading |

| Series A | $75M | Q4 2024 | Brevan Howard Digital, Galaxy Digital |

| Ecosystem Fund | $25M | Q1 2025 | Internal allocation + Haun Ventures |

This capital infusion focuses primarily on expanding technical infrastructure, growing institutional partnerships, and supporting projects building in the RWA ecosystem. With significant runway secured, the team can focus on long-term development rather than short-term token price movement.

Major Institutional Deals

The true measure of Plume’s potential lies in its ability to attract traditional finance players to blockchain infrastructure. Several key partnerships demonstrate early traction:

Banking & Finance:

- Integration with Cobo for institutional-grade custody solutions

- Partnership with Whinfell bringing $5B in institutional assets to the platform

- Active collaborations with Carlyle Group and Pimco to tokenize private credit products

Technology:

- RWA.xyz analytics platform integration for real-time tokenized asset insights

- Cross-chain bridges with 16 major networks via the SkyLink system

- Infrastructure partnership with Chainlink for reliable oracle services

Recent Developments:

- Q1 2025: Launched institutional trading desk with 24/7 OTC services

- Q2 2025: Mayet investment platform going live

- Q3 2025: Pilot program with top 5 global bank (details under NDA)

What makes these partnerships noteworthy isn’t just their scale, but that they represent actual implementation rather than speculative MOUs. Multiple deals have moved beyond testing to full integration, signaling growing institutional comfort with RWA tokenization.

Partnerships & Ecosystem

Plume has built a comprehensive ecosystem of partners and integrations designed to make RWA tokenization practical for both institutions and developers:

Strategic Alliances:

- Integration with RWA.xyz for specialized analytics on tokenized assets

- Partnership with Cobo providing institutional-grade custody solutions

- Working relationships with major banks like Whinfell

- Chainlink integration for secure price feeds and oracle services

- Cross-chain infrastructure deals with 16 major networks

Third-Party Integrations:

- Support for MetaMask, Trust Wallet, and Ledger hardware wallets

- Cross-chain bridges to Ethereum, BSC, Solana, and other major networks

- RWA marketplace integration with OpenSea and Rarible

- Asset management tools through Fireblocks and BitGo

- Yield aggregation via Mayet investment platform

Ecosystem Tools:

- Comprehensive SDK for RWA tokenization standardization

- Asset issuance API for institutional partners

- Open-source smart contract templates

- Developer documentation portal

- Custom analytics dashboard for tracking RWA performance

By creating both the infrastructure and tools, Plume lowers the barrier to entry for bringing traditional assets on-chain, addressing a key pain point that has historically limited RWA adoption.

Use Cases & Practical Examples

Scenario 1: Individual Investors

Bob wants exposure to private credit yields traditionally reserved for institutions. Through Plume, he can:

- Buy tokenized portions of institutional credit products

- Earn 7-9% APY on vetted assets

- Trade RWA tokens 24/7 with instant settlement

- Track performance through a simple dashboard

Scenario 2: Asset Managers

Sarah runs a small investment fund and uses Plume to:

- Tokenize real estate assets for fractional ownership

- Distribute yields automatically to token holders

- Access cross-chain liquidity for her clients

- Maintain regulatory compliance through built-in features

Scenario 3: Financial Institutions

A regional bank leverages Plume for:

- Converting corporate bonds into tradable tokens

- Reducing settlement times from days to minutes

- Cutting operational costs by 60%

- Accessing new distribution channels for products

These applications highlight how Plume bridges the gap between theoretical blockchain benefits and practical financial use cases, addressing real pain points for various market participants.

Security & Audits

Security is paramount when handling potentially billions in tokenized assets. Plume has undergone extensive security verification:

CertiK Audit (January 2025)

- Score: 95/100

- Found 2 medium-risk issues, both fixed pre-mainnet

- No critical vulnerabilities discovered

- Full report publicly available on GitHub

Quantstamp Review (December 2024)

- Verified smart contract security

- Highlighted strong architecture design

- Recommended minor optimizations for gas efficiency

- Team implemented all suggestions

Bug Bounty Program

- Up to $250,000 for critical vulnerabilities

- $25,000 average payout for valid reports

- Run through Immunefi platform

- 24/7 security monitoring

| Vulnerability Level | Reward Range | Response Time |

|---|---|---|

| Critical | $50,000-$250,000 | <12 hours |

| High | $10,000-$50,000 | <24 hours |

| Medium | $5,000-$10,000 | <48 hours |

| Low | $1,000-$5,000 | <72 hours |

Security Features

- Multi-sig required for all protocol changes

- Time-locked upgrades with 14-day delay

- Regular penetration testing

- Real-time transaction monitoring

Rather than treating security as a checkbox, Plume has integrated it throughout their development process, recognizing that institutional adoption requires enterprise-grade protection.

Core Features

Plume combines institutional requirements with user-friendly features, making RWA tokenization accessible to both major players and individual users:

Proof of Stake Consensus

- 3-second block times for rapid settlement

- 5,000+ transactions per second capacity

- Energy-efficient validation

- 100+ active validators

Smart Contract Platform

- Full EVM compatibility for developer familiarity

- Native Solidity support

- Custom RWA contract templates

- Developer SDK and API suite

Technical Capabilities

- Cross-chain asset bridge via SkyLink

- Built-in regulatory compliance tools

- Automated yield distribution

- Real-time oracle integration

Platform Advantages

- Zero-knowledge privacy features for sensitive data

- One-click asset tokenization

- Institutional-grade security

- 24/7 trading and settlement

These features work together to solve the primary challenges that have historically prevented RWA adoption on blockchain: regulatory compliance, institutional-grade security, and seamless interoperability.

Community & Governance

PLUME token holders play an active role in network governance through a structured voting system:

Governance Structure

PLUME token holders get voting power based on their staked amounts in the protocol. Each 10,000 PLUME staked equals 1 vote for governance decisions.

Voting Power & Rights

- 100,000+ PLUME: Submit governance proposals

- 50,000+ PLUME: Create minor protocol change requests

- 10,000+ PLUME: Vote on existing proposals

Active Communities

- Discord: 75,000+ members

- Telegram: 45,000+ members

- Reddit: 22,000 subscribers

- Twitter: 180,000+ followers

Community Programs

- Ambassador program with 500+ participants

- Monthly development grants

- Regular AMA sessions with the core team

- Regional community managers in 12 countries

| Community Channel | Size | Activity Level | Focus |

|---|---|---|---|

| Discord | 75,000+ | High | Technical support, development |

| Telegram | 45,000+ | High | News, updates, general discussion |

| 22,000 | Medium | Community discussions, tutorials | |

| 180,000+ | High | Announcements, partnerships |

This structured approach balances the need for ongoing community involvement with the stability required for institutional adoption, creating a hybrid governance model.

Detailed Tokenomics

The PLUME token model focuses on long-term alignment between holders and protocol growth through staking incentives and governance participation:

Token Distribution

- Public Sale: 20% (2B PLUME)

- Team & Advisors: 15% (1.5B PLUME)

- Ecosystem Growth: 40% (4B PLUME)

- Treasury: 15% (1.5B PLUME)

- Marketing: 10% (1B PLUME)

Staking Mechanics

- Current APY: 8-12%

- Minimum stake: 1,000 PLUME

- Unstaking period: 14 days

- Compound rewards option available

Vesting Schedule

- Team Tokens: 4-year vest, 1-year cliff

- Advisor Tokens: 2-year vest, 6-month cliff

- Private Sale: 25% at TGE, 6-month linear vest

- Public Sale: 40% at TGE, 3-month linear vest

Token Utility

- Gas fees for all network transactions

- Staking rewards and validator node operation

- Governance voting rights

- Protocol fee discounts (up to 50% based on stake)

- Collateral for RWA borrowing

This careful distribution balances the need for circulating supply with responsible token release schedules, avoiding the dramatic inflation that has plagued many Layer-1 projects.

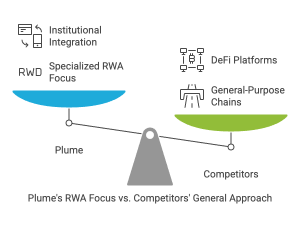

Comparison to Competitors

Plume distinguishes itself through its specialized focus on RWA tokenization, setting it apart from both general-purpose blockchains and DeFi platforms:

Layer-1 Blockchain Comparison

| Plume | Ethereum | Solana | Avalanche | |

|---|---|---|---|---|

| TPS | 5,000 | 15 | 65,000 | 4,500 |

| Finality | 3s | 12-15m | 0.4s | <2s |

| Gas Fees | $0.001 | $2-50 | $0.00025 | $0.05 |

| RWA Focus | Native | Limited | Limited | Partial |

While general-purpose L1s like Ethereum offer robust security and developer communities, they lack the specialized features needed for compliant RWA tokenization. Plume has built these capabilities directly into the base layer rather than attempting to add them afterward.

DeFi Platform Comparison

| Plume | Maker | Aave | |

|---|---|---|---|

| Asset Types | All RWAs | Crypto | Crypto |

| Yield Sources | Real-world | DeFi only | DeFi only |

| Regulatory Focus | High | Medium | Medium |

| Institution Ready | Yes | Partial | Partial |

Unlike pure DeFi platforms that focus primarily on crypto-to-crypto transactions, Plume bridges traditional assets with crypto yields through its SkyLink system, addressing the fundamental divide between TradFi and DeFi.

RWA Platform Comparison

| Project | Focus Area | Unique Approach | Similarities to Plume |

|---|---|---|---|

| Ondo Finance (ONDO) | Tokenized financial instruments | Decentralized investment bank model | Focus on institutional-grade financial products |

| Mantra (OM) | Regulatory compliance | Built on Cosmos SDK | Strong regulatory framework |

| RealT (REAL) | Real estate tokenization | Fractional property ownership | Makes illiquid assets tradable |

| MakerDAO (MKR) | Stablecoin backing | RWA-backed DAI reserves | Institutional partnerships |

| Realio Network (RIO) | Diverse asset tokenization | Private equity focus | Multiple asset class support |

Cross-Chain Infrastructure Players

Chainlink (LINK), while often categorized alongside RWA tokens, serves a broader purpose as a decentralized oracle network. It’s a critical infrastructure component for the entire RWA ecosystem, providing the essential data feeds that connect real-world asset information to blockchain environments. This enables accurate pricing, verification, and representation of traditional assets on-chain. Plume, like many RWA platforms, benefits from Chainlink’s oracle services to ensure reliable data for the assets it tokenizes.

Key Differentiators

Plume stands out through its laser focus on making RWAs work in crypto – from compliant tokenization to seamless yield distribution across chains.

Technical Advantages:

- Purpose-built RWA infrastructure rather than adapting general blockchains

- One-click asset tokenization with standardized templates

- Automated compliance checks built into the base layer

- Cross-chain yield distribution for maximum flexibility

- Institution-grade security with multi-sig and time-locks

Business Benefits:

- 60% lower operational costs compared to traditional systems

- 24/7 trading and instant settlement for previously illiquid assets

- Global distribution channels for traditionally local investments

- Automated yield payments reducing administrative overhead

- Full regulatory reporting suite for institutional compliance

Regulatory Compliance & Legal Status

Plume operates under a multi-jurisdictional regulatory framework designed to enable global RWA tokenization:

- Registered with FINMA in Switzerland as a blockchain infrastructure provider

- MiCA-compliant for EU operations

- Working with top crypto law firms for U.S. compliance strategy

The PLUME token maintains utility token classification in most jurisdictions, focusing on network operation and governance rather than investment contracts.

Regional Requirements

Current restrictions:

- Not available in New York State (BitLicense pending)

- Limited to accredited investors in certain U.S. states

- Restricted in countries with crypto bans

KYC/AML protocols:

- Mandatory verification on partner exchanges

- Built-in compliance tools for institutional users

- Automated screening of suspicious transactions

- Regular audits by third-party compliance firms

By taking a proactive approach to regulation, Plume positions itself to work within existing frameworks rather than against them – a crucial advantage for institutional adoption.

Potential Concerns & Criticisms

Despite promising technology and partnerships, Plume faces several challenges that potential users and investors should consider:

Network Centralization

Some critics point to Plume’s validator structure as a potential weakness:

- Current validator set limited to 100 nodes

- High minimum stake requirement (500,000 PLUME)

- Major institutions control significant token portions

The team has addressed these concerns by:

- Announcing plans to expand validator slots to 300 by Q4 2025

- Reducing minimum stake requirements gradually

- Implementing voter delegation features

Regulatory Uncertainty

Questions remain about:

- SEC classification of tokenized RWAs

- Cross-border compliance requirements

- Securities regulations for yield distribution

Plume’s approach includes:

- Built-in compliance tools for asset issuers

- Regular consultation with regulatory bodies

- Conservative expansion into new jurisdictions

- Partnership with top crypto law firms

Partnership Delivery

Critics note:

- Several announced partnerships haven’t launched products yet

- Timeline delays on institutional integrations

- Limited transaction volume compared to projections

Team response:

- Published detailed partnership roadmap with milestones

- Weekly progress updates on institutional onboarding

- Demonstration of working prototypes with major partners

Technical Challenges

Current limitations:

- Cross-chain bridge capacity constraints

- Oracle reliability for RWA pricing

- Gas spikes during high volume

Solutions in progress:

- Layer-2 scaling solution launching Q3 2025

- Enhanced oracle network with multiple providers

- Gas optimization upgrade scheduled for Q2

Community Feedback

Positive responses:

- Strong developer support for SDK and tools

- High satisfaction with institutional yields

- Appreciation for transparent communication

Common complaints:

- High initial barriers for small investors

- Complex onboarding process

- Limited trading pairs on major exchanges

The team maintains active dialogue through weekly AMAs and responds quickly to user concerns via their community channels.

Where to Buy PLUME

Centralized Exchanges (CEXes):

| Exchange | Availability | Trading Pairs | Links |

|---|---|---|---|

| Gate.io | Global (except US) | PLUME/USDT, PLUME/BTC | Trade |

| KuCoin | Most regions | PLUME/USDT, PLUME/BTC | Trade |

| Bybit | Restricted in US, UK | PLUME/USDT | Trade |

| MEXC | Global with KYC | PLUME/USDT | Trade |

DEX Listings:

- UniSwap V3 (Ethereum)

- Contract: 0x8B3192f5eEBD8579568A2Ed41E6FEB402f93f73F

- PancakeSwap (BSC)

- Contract: 0x9B7db724F05b4A36f7e81CF4466f42E7A2C4463B

Quick Purchase Guide:

- Create KuCoin account & complete KYC

- Deposit USDT or other supported crypto

- Navigate to PLUME/USDT trading pair

- Place market/limit order to buy PLUME

- Store tokens in supported wallet

Conclusion

Plume stands at the intersection of traditional finance and blockchain technology, addressing the crucial yet underdeveloped area of real-world asset tokenization. With strong institutional backing, a seasoned team bridging both worlds, and purpose-built infrastructure, the project shows promising signs of early traction.

The platform’s focus on bringing real-world assets to crypto positions it well in the emerging RWAfi sector, potentially capturing value from the projected $300 billion tokenized bond market by 2030. Key partnerships with established financial institutions like Whinfell and technical integrations with 16 blockchain networks demonstrate both vision and execution capability.

Plume is committed to bridging the gap between the payments industry and RWAfi by advancing PayFi and building a more open, accessible, and efficient on-chain economy. As the first full-stack L1 RWA Chain and ecosystem purpose-built for RWAfi, Plume enables rapid adoption and demand-driven integration of real-world assets across the financial landscape.

Additional Resources

Price estimates and market data as of March 30, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is highly volatile and speculative. All information presented about Plume (PLUME) and other tokens is based on publicly available data and may change as projects evolve. Always conduct your own research (DYOR) before making any investment decisions. Past performance is not indicative of future results. Consult with a qualified financial advisor regarding your specific situation before investing in any digital assets.